A landmark ruling¹ on August 5th declared Google a monopolist, accusing the tech giant of abusing its power to stifle competition. The U.S. District Court found that Google used billions of dollars to lock in its position as the default search engine on devices from Apple to Samsung. This decision could reshape the digital landscape, with potential implications for everything from how we search online to the marketing strategies of businesses and higher education institutions alike.

As the dust settles, universities must prepare for a new era of search. In this article, Everspring’s SVP of digital marketing, Matt Zaute, and VP of growth marketing, Rhea Vitalis, explore five key trends emerging in the wake of Google's antitrust battle and outline how higher education institutions can adapt to thrive in this evolving environment.

First Things First—What Transpired?

Here’s a summary of the Google antitrust ruling:

- On Monday August 5th, U.S. District Judge Amit Mehta ruled, “Google is a monopolist, and it has acted as one to maintain its monopoly.”

- The judge invoked Section 2 of the Sherman Antitrust Act (consider Senator Sherman and Standard Oil parallels²).

- The application in Google’s case boils down to the following:

- Google acquired a monopoly in search through innovation; no problem here.

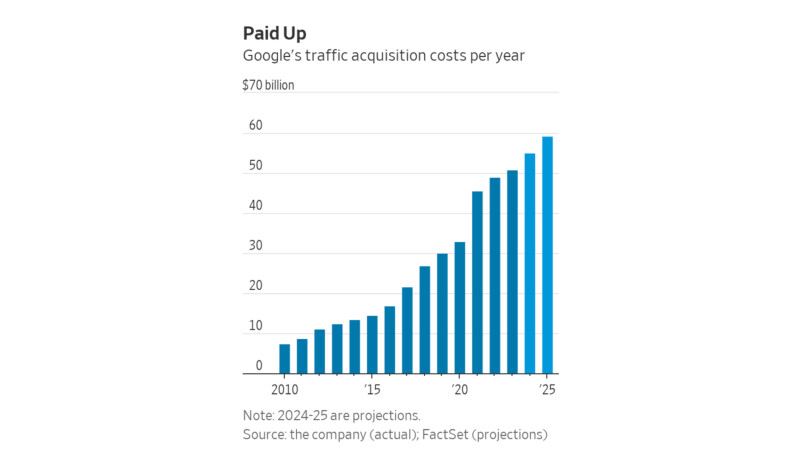

- However, once it becomes a monopoly, it is forbidden from extending that monopoly through the use of contractual arrangements. Google spends ~$50 billion a year doing just that.

How Did We Get Here?

The argument brought before the court by the U.S. Justice Department and 38 U.S. states was first filed on October 20, 2020. Plaintiffs contended Google limited competition by paying billions of dollars to operators of web browsers and to phone manufacturers to be the default search engine. As the default search engine on devices from Apple to Samsung, Google stifled competition and expanded its search dominance. Google executes about 90% of the world’s internet searches.³

What Happens Now?

Judge Mehta will rule on potential remedies to Google’s behavior within the coming months:

- At one extreme, Google could be forced to sell its Chrome browser and/or Android mobile software business.

- The most likely outcome is Google will be prevented from “paying for placement” of its browser on manufacturers’ devices.

The ruling and its remedies will have an immediate impact on Apple, Samsung, and Microsoft. Google’s traffic acquisition costs are currently around $55 billion. These funds are payments to wireless carriers, device makers and browser companies. In 2022 alone, Google paid Apple⁴ $20 billion to be the default browser in Safari and iOS, which constituted 5% of Apple’s revenue. There is a long history⁵ of contractual arrangements between Google and Apple dating back to the first iPhone launch in 2007.

Image Source: The Wall Street Journal⁶

Microsoft benefits from this ruling to the extent it opens up competition for default browser placement. However, Bing is starting from a very low install base with only 5-6% of searches occurring on Bing.

Google plans to appeal the ruling, which could take years.

How Will This Impact Search and Website Traffic?

There is precedent in Europe for how this ruling could impact search. In 2018, the EU ruled against Google and its default search engine position.⁷ As a remedy, new Android devices offer a “choice screen” of default search engines. Google market share of searches in the EU has not declined subsequently, reflecting the preference and affordance of Google search. Google is cemented as the place where interaction with the internet begins. Remember when Merriam-Webster first included it as a verb in 2006?

Over the long term, competitors and new technologies (e.g., AI) will encroach on Google’s search dominance. But it won’t happen quickly. The install base and mind-share of Google is just too great. Microsoft has invested over $100 billion in Bing⁸ for a 5% market share, which is to say Google search isn’t going away anytime soon. However, the advent of new search technologies (AI) coupled with continued antitrust issues present a threat to Google’s continued dominance.

Here are 5 critical trends for universities to watch amidst Google’s antitrust trial and rulings:

Trend 1: Diversification of Traffic Sources

- Explanation: The rise of AI-powered search tools, like ChatGPT, is creating new traffic sources for university websites. Already we are observing increased incidences of ChatGPT, Perplexity, Anthology and others as a traffic source in web analytics. While these tools still prioritize quality content, the way users interact with search and find information is evolving.

- Impact: Universities must adapt their content strategy to be discoverable by both traditional search engines and AI-powered platforms.

Trend 2: Content Quality Remains Paramount

- Explanation: Despite potential changes in search algorithms, high-quality, authoritative content will continue to be valued.

- Impact: Universities should focus on creating content that demonstrates expertise, experience, authority, and trustworthiness (E-E-A-T) to maintain visibility and credibility.

Trend 3: Critical Importance of Connected Data

- Explanation: Just last month, university CMOs cited a data fragmentation crisis. Sixty-one percent said they lack a consolidated dashboard for marketing efforts.⁹ Yet, an increasingly complex digital landscape, changing student behavior, and competitive market necessitate this visibility for successful enrollment marketing.

- Impact: Universities must invest in data infrastructure, integration, and analytics tools to gain actionable insights, observe student behavior across the funnel, and make data-driven decisions.

Trend 4: Adaptability in PPC Strategies

- Explanation: Potential changes in Google's advertising policies may impact PPC campaigns. Universities need to be agile and capable of adjusting their strategies to reach target audiences effectively.

- Impact: Building a strong foundation in PPC fundamentals, staying updated on industry trends, and adjusting PPC strategy with a clear line of sight to down-funnel performance is crucial for successful campaigns.

Trend 5: Prioritizing First-Party Data

- Explanation: We've gone through many iterations of tracking user behavior and preferences, but capturing data is becoming harder. Because of this, the future of higher ed performance marketing hinges on first-party data strategies.

- Impact: Universities should focus on collecting and leveraging first-party data, connecting media data with CRM data, and accessing critical first-party benchmark data. This enables schools to build robust customer profiles, personalize communications, guide successful strategies with a bigger picture, and measure marketing ROI.

Do you want to know more about the Google antitrust ruling and how it could impact your university’s marketing efforts? Contact Everspring’s digital marketing experts.

About Everspring

Everspring delivers comprehensive marketing solutions powered by our proprietary enrollment marketing platform. This platform empowers higher education institutions to optimize ad spend, measure campaign performance, and drive enrollment growth. Our higher education digital marketing services—including paid media, strategy, SEO, and content—are designed to deliver measurable results: enrolled students who thrive in your university’s programs.

1. United States Court for the District of Columbia

2. Sherman Antitrust Act, Legal Information Institute

3. Search Engine Market Share Worldwide, Statcounter Global Stats

4. Bloomberg

5. Search Engine Land

6. The Wall Street Journal

7. The Wall Street Journal

8. Windows Central

9. Simpson Scarborough